Master the art of strategic financial decision-making and investment banking, fostering ethical and sustainable growth in the corporate world.

Discover our program

Make your mark in the fast-paced world of banking and finance.

Dive into the complex intersection of financial strategy, investment decisions, and market dynamics with our MSc in Corporate Finance and Investment Banking. This program is designed for ambitious professionals who want to go beyond theory and gain hands-on expertise in corporate valuation, mergers and acquisitions, risk management, and capital markets.

Through a combination of rigorous coursework, real-world case studies, and exposure to leading industry practices, you will develop the strategic thinking, analytical skills, and technical knowledge needed to excel in today’s global financial landscape. Whether your goal is to work in investment banking, corporate finance, or advisory, this program provides the foundation and competitive edge to thrive in a highly dynamic and competitive industry.

-

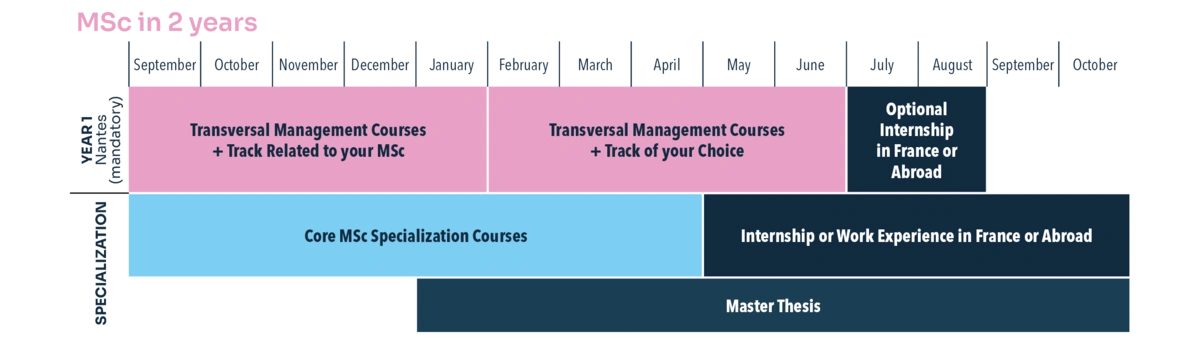

Rhythm:Full time

-

Total duration:26 months maximum

-

Degree:Master of science - Grade Master, Visé BAC+5

-

Language(s):English

-

Format:Presential

-

Campus:Audencia Atlantic Campus - Nantes, Paris Campus - Paris

-

Start Date:2026-09-01

-

Number of places:30

-

VAE accessible:No

-

Duration of internship / Work experience:4-6 months

-

RNCP Title:RNCP Title : Niveau 7 - Diplôme d’Études Supérieures en Management Global

Program Benefits

- Understand financial instruments and the dynamics of capital markets

- Analyze corporate financing and investment alternatives

- Evaluate merger opportunities

- Determine the value of an acquisition

- Make corporate finance decisions that maximize financial and social value for all stakeholders in an international context