Become a CFA-certified financial analyst at one of the leading institutions in the field of sustainability.

Discover our program

The MSc in Financial Analysis and Investment Management is built around the curriculum of the CFA (Chartered Financial Analyst). It covers a wide set of topics in Corporate Finance, Financial Markets, Economics and Ethics. It is designed to help you to successfully prepare for the CFA Certification exams (Level 1 and 2), if you choose to take these exams.

Due to Audencia's affiliation with the CFA Institute, there is a limited number of scholarships which cover some of the CFA examination fees (subject to availability).

Students can also benefit from access to valuable financial data sources use by practitioners, notably the Bloomberg terminals in Audencia's Trading Room, as well as Refinitiv Eikon.

-

Rhythm:Full time

-

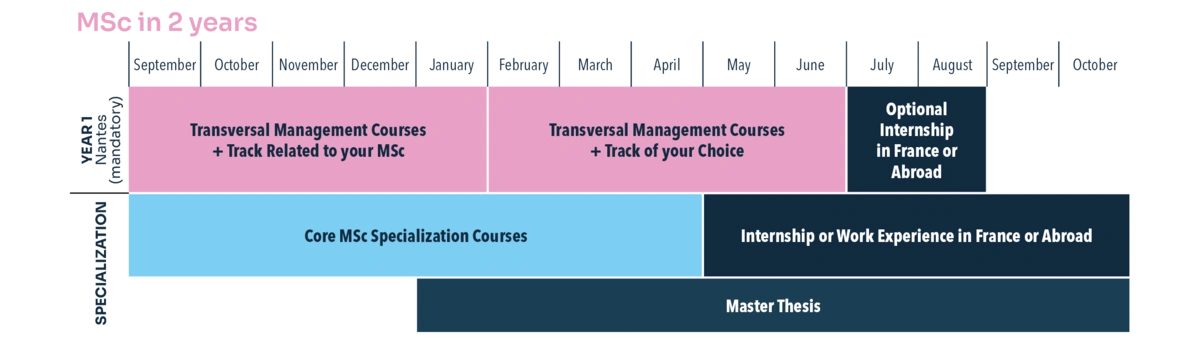

Total duration:26 months maximum

-

Degree:Master of science - Grade Master, Visé BAC+5

-

Language(s):English

-

Format:Presential

-

Campus:Audencia Atlantic Campus - Nantes

-

Start Date:2026-09-01

-

Number of places:30

-

VAE accessible:No

-

Entry level:Graduate

-

Duration of internship / Work experience:4-6 months

-

RNCP Title:RNCP Title : Niveau 7 - Diplôme d’Études Supérieures en Management Global

Program Benefits

- Develop skills that are in high demand by employers worldwide.

- Prepare for the Chartered Financial Analyst (CFA) certification.

- Encourage Investments that are both profitable and sustainable.